Building a custom home from scratch is a dream for many. Financing the process can be more complex than buying an existing home. One popular financing option is a construction loan, which provides the funds to build your home. However, like any financial product, construction loans have their own set of pros and cons.

Before you begin your home-building journey, it’s crucial to weigh the advantages and disadvantages of construction loans to determine if they’re the right choice for your project.

The Pros of Construction Loans

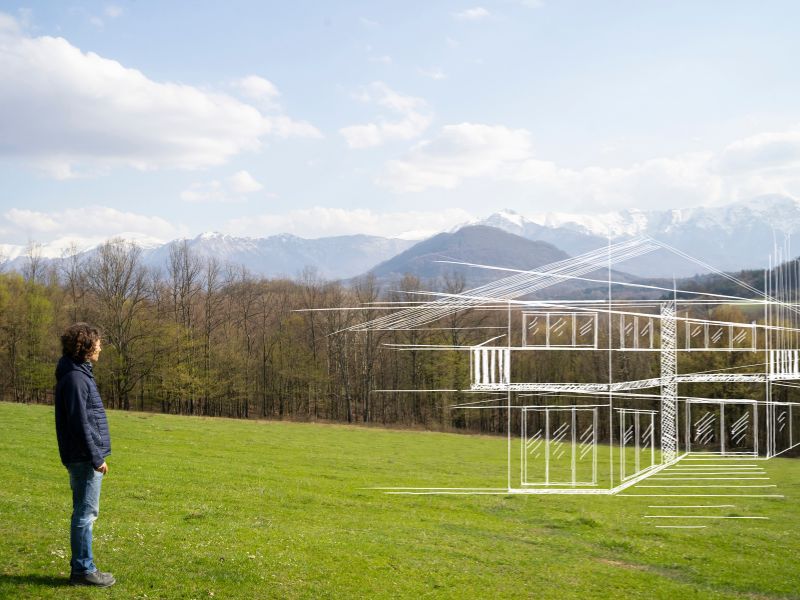

- Flexibility to Customize Your Home One of the biggest benefits of construction loans is the flexibility they offer. Unlike buying a pre-existing home, a construction loan gives you the ability to design and build a home that meets your specific needs and preferences. You have control over every detail, from layout to materials, allowing you to create a home tailored to your tastes.

- Interest-Only Payments During Construction During the construction phase, many construction loans require interest-only payments. This keeps your costs lower while the home is being built, giving you financial flexibility to manage other expenses related to the build.

- Structured Payment Plan Construction loans operate with a draw schedule, where the lender releases funds to the builder in phases as construction progresses. This structured payment plan keeps the project on track and ensures that funds are only released when specific milestones are met, reducing the chance of financial mismanagement.

- Increased Oversight Lenders typically provide oversight during the construction process, conducting regular inspections and checkpoints to ensure everything is proceeding according to plan. This added layer of accountability can give you peace of mind that your home is being built to standards and on schedule.

- Potential to Increase Property Value By building your home, you can incorporate modern, energy-efficient features and plan for future expansions. These choices can potentially increase your home’s long-term value, offering a higher return on investment (ROI) compared to buying an existing home.

The Cons of Construction Loans

- Higher Interest Rates Construction loans generally carry higher interest rates than traditional mortgages. Lenders consider them riskier because the home doesn’t yet exist. Although you can reduce these rates once the construction is complete and the loan converts to a permanent mortgage, higher rates will increase your overall borrowing costs during the build.

- Short-Term Loan Most construction loans are short-term, typically lasting 12 to 18 months. If your home isn’t completed within that time, you may face penalties or need to refinance, which can add to your costs and stress. Construction delays can complicate the process and push the timeline beyond your expectations.

- Strict Qualification Requirements Qualifying for a construction loan is often more difficult than for a traditional mortgage. Lenders generally require a higher credit score, a detailed construction plan, and a reputable builder. Failing to meet any of these criteria could hinder your ability to secure financing.

- Down Payment and Closing Costs Construction loans usually require a larger down payment—often 20% to 30% of the loan amount. You’ll also need to account for closing costs at the beginning of the loan and again when transitioning to a permanent mortgage, which could increase your upfront expenses.

- Risk of Construction Delays Despite careful planning, construction projects are known for delays due to weather, supply chain disruptions, or labor shortages. These delays can increase costs as you continue paying rent or a mortgage on a temporary residence.

Construction loans offer an opportunity to build your dream home, providing flexibility and customization that existing homes can’t. However, they come with risks, including higher interest rates, strict qualification requirements, and potential delays.

If you’re ready to face the challenges and eager to create a home that perfectly fits your needs, a construction loan may be the perfect way to finance your build. Still unsure? Give us a call, and we’ll walk you through all your mortgage options.

![EdCurrie_Logo White[Transparent] EdCurrie_Logo White[Transparent]](https://edcurrie.com/wp-content/uploads/elementor/thumbs/EdCurrie_Logo-WhiteTransparent-qybu3sjgpfhje9098uitv7fpt7os2hgn52gfy6ocx4.png)