How to Craft Your Dream Kitchen with a Construction Loan: Essential Tips for Home Builders

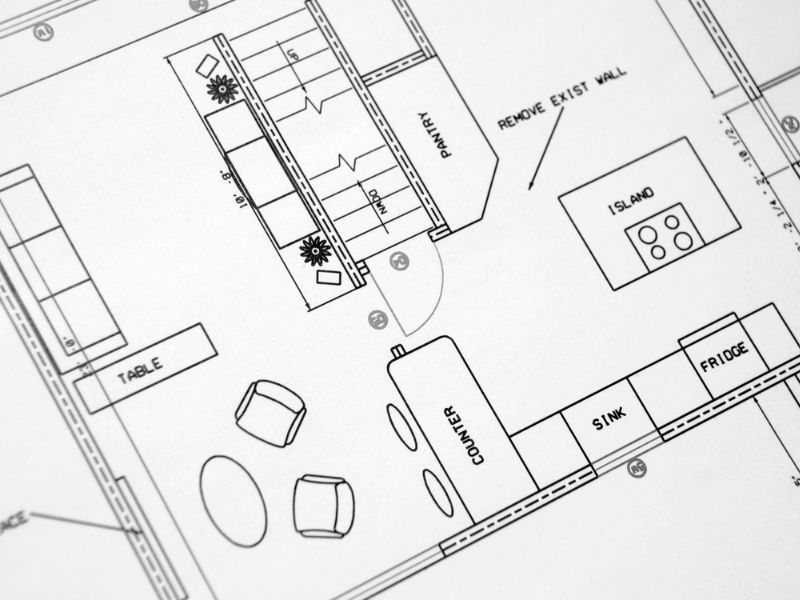

Embarking on the journey of building your dream home is an exciting adventure, and one of the most crucial spaces within that realm is undoubtedly the kitchen. As the heart of the home, the kitchen serves as a hub for culinary creativity, social gatherings, and everyday living. Designing a kitchen that reflects your style, accommodates